CROOKS ON CAMPUS

CROOKS ON CAMPUS

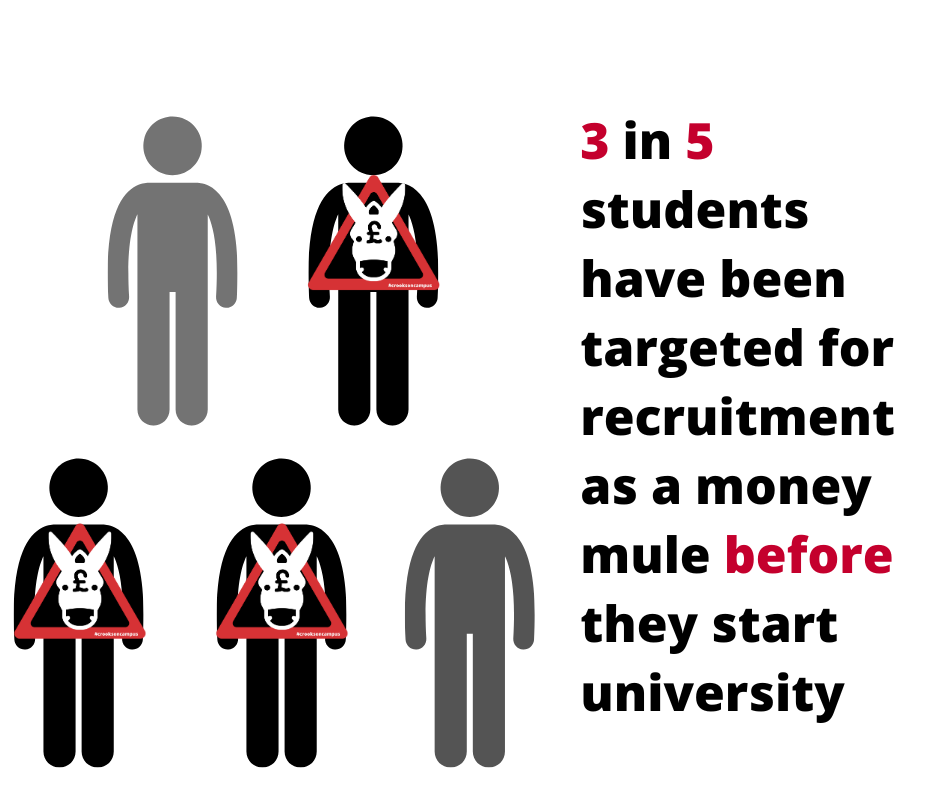

New figures reveal 3 in 5 students have been targeted by criminals to become money mules

A growing number of students are being targeted by criminal gangs to launder money through their student bank accounts. New figures show that 3 in 5 students have been approached in person or online to become a money mule. Even more worrying is that 52 % didn’t know what a money mule was and 47 % thought it was okay to let someone use their bank account to transfer money. The research was conducted by Dr Nicola Harding at Lancaster University. These shock new figures come as it is revealed that money muling has increased in the UK by 24% with a 19% rise in those aged under 21 years according to Cifas, the UK’s fraud prevention community Fraudscape 2022 report.

We Fight Fraud’s new initiative to try to help students – in partnership with Lloyds Bank and City of London Police – is to be rolled out at universities across London. ‘Crooks on Campus’ – We Fight Fraud’s powerful criminal drama that brings to life the reality of organised financial crime and the consequences for students if they become a money mule – is to be released to students. Originally piloted with the National Crime Agency, the film produced significant awareness and behavioural change among the student population, with 90% of students rejecting money mule recruitment messages. It is hoped that this project, which also incorporates training for university staff, and student representatives sharing information on campus will stop students from allowing criminals to use their bank accounts – making it increasingly harder for them to access their criminal funds. It will be rolled out across universities in London during ‘freshers’ week and the beginning of the new academic term.

Co-written and produced by social engineering expert, and former fraudster, Tony Sales, the film accurately depicts how criminals’ ‘clean’ money they have obtained through fraudulent activity such as ‘HMRC’ telephone scams, revealing the role the money mule has as criminals steal from a victim of fraud. The film is based on real life stories of victims and criminals gathered from We Fight Fraud’s intelligence-gathering activities.

Brian Dilley, Group Director of Economic Crime Prevention, Lloyds Bank, said:

“We are very proud at Lloyds Bank of the partnership we’ve built together with City of London Police. Since joining forces in 2018, our relationship has given us a unique opportunity to design and deliver fraud prevention initiatives which have improved the detection of crime, helping the police to catch criminals and protect the public.

Fraudsters try every trick in the book to get their hands on victims’ cash and they’re busy recruiting others as ‘money mules’ to unwittingly handle their stolen funds, most commonly through social media. Students can be particularly vulnerable given they might be living away from home for the first time and looking for extra income.

It’s really important that young people understand more about the consequences of being caught moving fraudulent funds. Tempting offers that sound too good to be true probably are, so it’s important to think about the consequences.

Unsuspecting mules’ risk being left with no bank account, a damaged credit score and the inability to apply for a mortgage, loan or even a phone contract in the future. They could face up to 14 years in prison”.

T/Detective Chief Superintendent Matt Bradford, City of London Police, states:

“Students are targeted by criminals and Organised Crime Groups (OCGs) to become money mules. They are recruited, sometimes unwittingly, transfer illegally obtained money between different bank accounts. Money mules receive the stolen funds into their account, they are then asked to withdraw it and wire the money to a different account, often one overseas, keeping some of the money for themselves.

Even if money mules are unaware that the money they are transferring was illegally obtained, they have played an important role in fraud and money laundering, and can still be prosecuted. Criminals will often use fake job adverts, or create social media posts about opportunities to make money quickly, in order to lure potential money mule recruits.

City of London Police, the national lead force for fraud, is delighted to partner with Lloyds Banking Group and We Fight Fraud, to highlight the significant risk of fraudsters targeting university students, and educate them on avoiding becoming money mules. This is a sophisticated crime that has serious implications for those duped into becoming involved, as the ‘Crooks on Campus’ film demonstrates. Raising awareness of money muling is part of the preventative approach to combating money muling operations, progressed through our partnership activities with the banking industry, National Crime Agency and other law enforcement partners.

Students can protect themselves by

- Not responding to job adverts, or social media posts that promise large amounts of money for very little work.

- Researching a potential employer, particularly one based overseas, before handing over your personal or financial details to them.

- Not allowing an employer, or someone you don’t know and trust, to use your bank account to transfer money.

Report any suspicions of money muling to CrimeStoppers on 0800 555 111, or the police.”

For more information about We Fight Fraud visit wefightfraud.org, you can watch the trailer and find out more at crooksoncampus.co.uk